Employer contribution payroll tax calculator

Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer. Learn About Payroll Tax Systems.

Remitting Employee Deductions In Canada Valley Business Centre

Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible wages.

. Social Security tax and Medicare tax. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2. We calculate file and pay all federal state and local payroll taxes on your behalf.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. FICA stands for the Federal Insurance Contributions Act and is a federal tax that is withheld from every persons paycheck.

Over 900000 Businesses Utilize Our Fast Easy Payroll. The majority of companies in North America now outsource payroll tax preparation and filing 76 year-end tax form printing 87 year-end tax form distribution 63 check printing. This contribution rate is less because small employers are not.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. All Services Backed by Tax Guarantee. Determine withholdings and deductions for your employees in any state with Incfiles simple payroll tax calculator.

A 401 k match is an employers percentage match of a participating employees contribution to their 401 k plan usually up to a certain limit denoted as a percentage of the employees. If youre checking your payroll. The maximum an employee will pay in 2022 is 911400.

Keep in mind that some pre-tax deductions eg Section 125 plans can lower the gross taxable wages and impact how much. Ad Fast Easy Accurate Payroll Tax Systems With ADP. FICA constitutes of two taxes.

After you have determined that you are an employer a trustee or a payer and have opened a payroll program. Medicare 145 of an employees annual salary 1. Could be decreased due to state unemployment.

Our online service is available anywhere anytime and includes unlimited customer support. Changes to the rules for deducting Canada Pension Plan CPP contributions. Plug in the amount of money youd like to take home.

Sign Up Today And Join The Team. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Learn About Payroll Tax Systems.

Employer Paid Payroll Tax Calculator. If you want a. The employer cost of payroll tax is 124.

Sign Up Today And Join The Team. With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. Free salary hourly and more paycheck calculators.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. These are contributions that you make before any taxes are withheld from your paycheck.

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Tax Calculator For Employers Gusto

What Is Fica Tax Contribution Rates Examples

Your Easy Guide To Payroll Deductions Quickbooks Canada

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Mathematics For Work And Everyday Life

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

How To Calculate Payroll Taxes Methods Examples More

6 Free Payroll Tax Calculators For Employers

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Mathematics For Work And Everyday Life

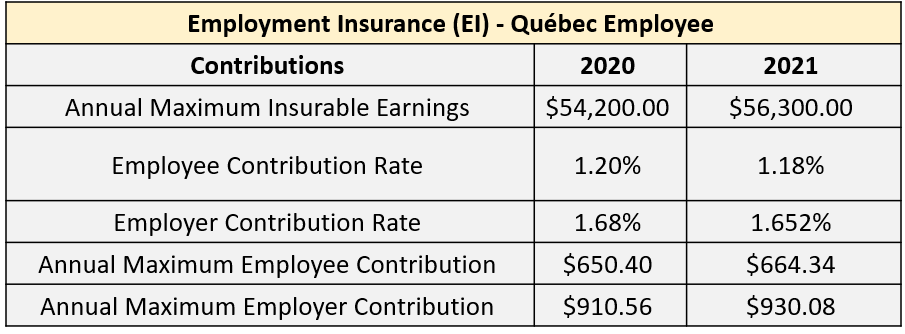

Everything You Need To Know About Running Payroll In Canada

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

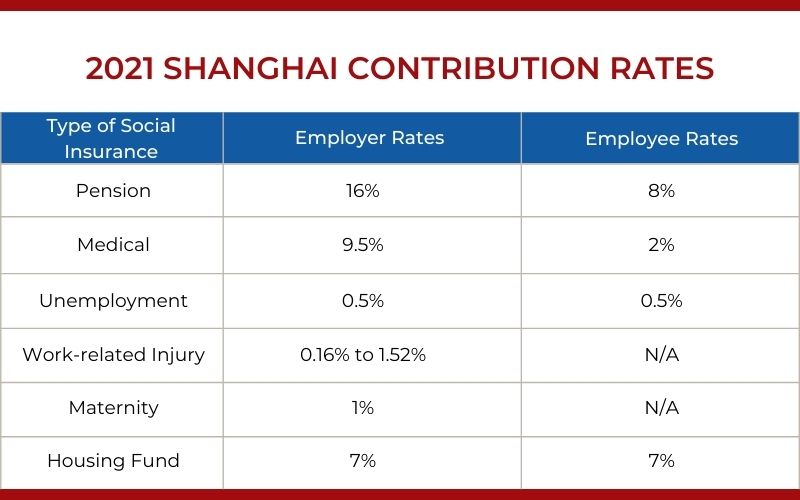

Best Payroll In China Guide 2022 Structure And Calculation Hrone

How To Calculate Payroll Tax Deductions Monster Ca